S corporations must use Schedule B (100S), S Corporation Depreciation and Amortization.ĭepreciation is the annual deduction allowed to recover the cost or other basis of business or income producing property with a determinable useful life of more than one year. Use form FTB 3885, Corporation Depreciation and Amortization, to calculate California depreciation and amortization deduction for corporations, including partnerships and limited liability companies (LLCs) classified as corporations. Taxpayers should not consider the instructions as authoritative law.

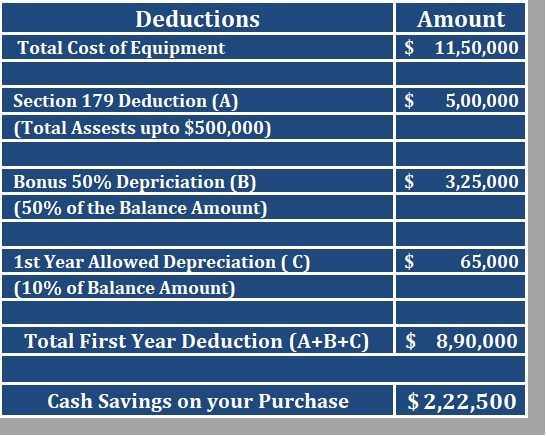

IRC 179 CODE

It is not possible to include all requirements of the California Revenue and Taxation Code (R&TC) in the instructions. We include information that is most useful to the greatest number of taxpayers in the limited space available. The instructions provided with California tax forms are a summary of California tax law and are only intended to aid taxpayers in preparing their state income tax returns. 1001, Supplemental Guidelines to California Adjustments, the instructions for California Schedule CA (540 or 540NR), and the Business Entity tax booklets. Additional information can be found in FTB Pub.

For more information, go to ftb.ca.gov and search for conformity. When California conforms to federal tax law changes, we do not always adopt all of the changes made at the federal level.

However, there are continuing differences between California and federal law. In general, for taxable years beginning on or after January 1, 2015, California law conforms to the Internal Revenue Code (IRC) as of January 1, 2015. For more information, see B Federal/State Differences. California does not conform to the federal amendments under the TCJA. What's Newĭepreciation Limitations– The Tax Cuts and Jobs Act (TCJA) amended IRC Section 280F relating to depreciation limitations on luxury automobiles. References in these instructions are to the Internal Revenue Code (IRC) as of January 1, 2015, and to the California Revenue and Taxation Code (R&TC).

0 kommentar(er)

0 kommentar(er)